.

E já agora, pode-se despachar uma cópia para Daniel Amaral que nos quer convencer que reduzir salários é de esquerda.

.

Os autores com base nos dados de 1200 grandes empresas dispersas pelo mundo chegaram aos seguintes valores médios:

"Starting with price indexed to 100, we see that fixed costs (items like overhead, property, and depreciation that do not vary when volume changes) amount to an indexed average of 24.5 percent of price. Variable costs (expenses like labor and materials that shift in tandem with volume) account for another 66.4 percent. This leaves an average return on sales (ROS) of 9.1 percent.

"Starting with price indexed to 100, we see that fixed costs (items like overhead, property, and depreciation that do not vary when volume changes) amount to an indexed average of 24.5 percent of price. Variable costs (expenses like labor and materials that shift in tandem with volume) account for another 66.4 percent. This leaves an average return on sales (ROS) of 9.1 percent.Now, against these average Global 1200 economics, how much is it worth to improve your price by 1 percent? Assuming volume remains steady, price will rise to 101, fixed costs by definition are unchanged, and, since there is no change in volume, variable costs are also constant.

.

Operating profit, however, rises to 10.1 percent from 9.1, a relative increase of 11 percent.

.

The clear message is that very small improvements in price translate into huge increases in operating profit. When you talk about creating a pricing advantage, you may have to recalibrate your thinking about the significance of very small change. Pricing initiatives that increase average prices by only a quarter or a half percent are important because they bring

disproportional increases in operating profit. A 1 or 2 percent price improvement is a major victory with significant profit implications. Find 3 percent—and many companies can, once they start looking—and operating profit can jump by more than 30 percent, using average Global 1200 economics.

Pricing is far and away the most powerful profit lever that a company can influence. Continuing with average Global 1200 economics, Exhibit 1-2

illustrates what happens to operating profit when each of the other levers is improved by 1 percent, while the other factors stay constant. (Moi ici: os números são quase semelhantes aos de Rosiello)

illustrates what happens to operating profit when each of the other levers is improved by 1 percent, while the other factors stay constant. (Moi ici: os números são quase semelhantes aos de Rosiello)...

Unfortunately, the pricing lever is a double-edged sword. No lever can increase profits more quickly than raising price a percentage point or two, but at the same time nothing will drop profits through the floor faster than letting price slip down a percentage point or two. If your average price drops just a single percentage point, then assuming your economics are similar to the Global 1200 average, your operating profits decrease by that same 11 percent.

.

Quando nos acenam com a ideia de reduzir os salários... não! Ideia não! Quando nos acenam com o mito de reduzir os salários, mito por que é como o TGV, algo que se acena sem fazer contas, sem questionar... quando nos acenam com o mito de reduzir os salários acreditam que escaparemos com um tradeoff, reduzindo os salários reduziremos os custos fixos e por isso reduziremos o preço tornando-nos mais competitivos. Só que basta olhar para aquela figura acima... 1% de redução dos custos fixos só aumenta os lucros operacionais em 2.7%!!!

.

Mas Marn et al também abordam este mito do "price/volume tradeoff":

.

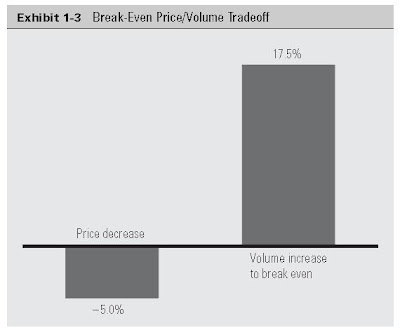

"If I lower my price, can I increase volume enough to generate more operating profit? Exhibit 1-3 explores how that tradeoff works—or, more accurately, does not work. If a business takes steps that effectively reduce average prices by 5 percent, how much of a volume increase would be necessary to break even on an operating profit basis?

With economics similar to the Global 1200 average, a 5 percent price decrease would require a 17.5 percent volume increase, not to increase operating profits but just to break even. Such an increase is highly unlikely. For a 5 percent drop in price to generate a 17.5 percent volume

rise would require a price elasticity of –3.5:1. That is, every percentage point drop in price would have to drive unit volume up by 3.5 percent.

rise would require a price elasticity of –3.5:1. That is, every percentage point drop in price would have to drive unit volume up by 3.5 percent.Our experience in real markets shows price elasticities commonly reach a maximum of only –1.7:1 or –1.8:1. On rare occasions, usually for consumer items purchased on impulse, it might be as high as –2.5:1. In the real world, –3.5:1 price elasticity is extremely rare. Thus, the basic arithmetic of decreasing price to increase volume to increase profits just does not add up. Note that you should do this calculation using the economics of your own business to confirm how the price/volume/profit tradeoff works for you."

Sem comentários:

Enviar um comentário